Answer:

They will refinance and by using half the amount saved they will end up with a value of $225,017.41 at the end of the mortage in their saving account.

Step-by-step explanation:

House 250,000

downpayment 15% of 250,000 = 37,500

balance 212,500

over 30 years at 7.75% compounded monthly.

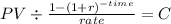

monthly payment:

PV 212,500

time 360 (30 years x 12 month per year)

rate 0.006458333 (7.75% over 12 month per year)

C $ 1,522.376

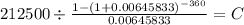

Balance after 5 year:

PV of the monthly payment at mortgage rate

C 1,522.38

time 300

rate 0.006458333

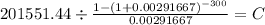

PV $201,551.4404

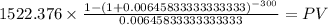

they will refinance 201,551.44 at 3.5%

PV 201,551

time 300

rate 0.002916667

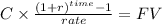

C $ 1,009.014

Difference: 1,522 - 1,009 = 513 dollars

From which they invest half this amount at 7.25% compounded monthly

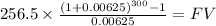

The future value of this invesmtent will be of:

C 256.50

time 300

rate 0.00625

FV $225,017.4136