Answer:

The Customer's total cost for DVD was $19.26

Explanation:

Given:

Purchase price of DVD = $12

Sold amount = 50% more than purchase amount.

So we will first calculate the amount at which the DVD was sold.

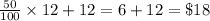

Selling Price of DVD =

Sales tax imposed = 7%

So we will find the amount charged in Sales tax.

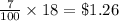

The amount charged in Sales tax can be calculated by multiplying sales tax percent with Selling Price of DVD and then dividing by 100.

framing in equation form we get;

The amount charged in Sales tax =

Now we need to find the Total cost for DVD.

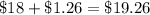

Total cost for DVD is equal to sum of the amount at which the DVD was sold and the amount charged in sales tax.

framing in equation form we get;

Total cost for DVD =

Hence The Customer's total cost for DVD was $19.26