Answer:

Interest will be $368

So option (B) will be correct answer

Step-by-step explanation:

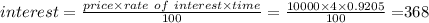

We have given Markle purchased a ten year $10000 bond

So price of bond = $10000

Rate of interest = 4 %

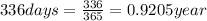

Time = 336 days

We know that 1 year = 365 days

So

So interest will be equal to

So option (B) will be correct answer