Answer:

a) attached files.

b) if they are forcer to decrease pollution by 4,000 tons then:

firm A cost 160,000

firm B cost 240,000

c) if there is a ton of $240 per ton oth firm will find more attractive to emliminate pollution than to pay taxes.

Step-by-step explanation:

Marginal cost for Plant 1 = 0.02Q

Marginal cost for Plant 2 = 0.03Q

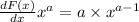

The marginal cost represent the derivate of the cost fuction

so we solve for the cost function as follow:

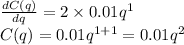

we got 0.02 as dC(q)/dq

so the cost fuction is:

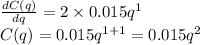

same procedure for hte second plant

Now we made the graph of this function

We slve for q = 4,000

0.01 x 4,000^2 = 160,000

0.015 x 4,000^2 = 240,000

If there is a tax for 240 dollar per ton then, the factory will eliminate tons up to that amount so it finds equilibrium.

0.02q = 240

q = 240/0.01 = 12,000

Plant 1 will eliminate the entire 8,000 tons as is below the tax floor

Plant 2

0.03q = 240

q = 240/0.03 = 8,000

Plant 2 will also eliminate pollution as is preferable to pay the taxes.