Answer:

The month payment amount is $897.589

Interest amount is $61,566

Explanation:

Given as :

The price of the house = $125,000

The down payment amount for house = 20% of total price

i.e The down payment amount for house = 20% × $125,000

Or, The down payment amount for house =

× $125,000

× $125,000

Or, The down payment amount for house = $25,000

Now, Balance amount = total price - down payment

Or, Balance amount = $125,000 - $25,000

Or, Balance amount = $100,000

So, The balance amount is bring finance

The finance principal amount = p = $100,000

The rate of interest applied = r = 3.25%

The time period of mortgage = t = 15 years = 15 × 12 = 180 months

Let The Amount of mortgage after 15 years = $A

From Compound Interest method

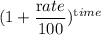

Amount = Principal ×

Or, A = p ×

Or, A = $100,000 ×

Or, A = $100,000 ×

Or, A = $100,000 × 1.61566

Or, A = $161,566

So,The Amount of mortgage after 15 years = $161,566

Interest applied = Amount - principal

Or, I = $161,566 - $100,000

∴ Interest = $61,566

Again

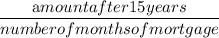

The month payment amount =

i.e The month payment amount =

Or, The month payment amount = $897.589

Hence The month payment amount is $897.589 and interest amount is $61,566 . Answer