Answer:

The income will they have left over after paying their federal income tax is $64,850.00.

Explanation:

Given:

A married couple filing their federal income tax return jointly had a taxable

income of $76,300.

Now, to find according to the table the income will they left over after paying their federal income tax.

So, as given in table:

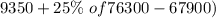

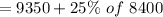

The tax of the taxable income over $67,900 but not over $1,37,050 is $9,350 plus 25% of the amount over $67,900.

As, the taxable income $76,300 falls in to the above conditions.

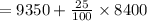

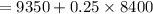

Now, to calculate the tax:

Thus, the tax = $11450.

Now, deducting the tax from the taxable income:

So, the amount left = $64,850.

Therefore, the income will they have left over after paying their federal income tax is $64,850.00.