Answer:

IRR= 23.375%

Step-by-step explanation:

Given: Cash flow= $1,200,000

Initial investment= $2400000

Lets first compute IRR for Project, assuming rate of return at 23.375% or 0.233.

Formula:

NPV has to be equal to zero to know if IRR is correct to find if project worth enough to invest.

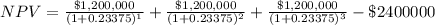

⇒

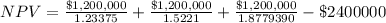

⇒

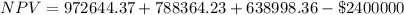

⇒

∴ NPV= 0

Hence, 23.375% is the IRR for the project.