Answer:

The total amount to be paid for new home is $838,014.72

Explanation:

Given as :

The price of the new house = $256,000

The down payment amount = 30% of house price

So, The down payment price = 30% of $256,000

i.e The down payment price =

× 256000

× 256000

Or, The down payment price = $76,800

Now, rest amount is finance

So, The finance Amount = p = $256000 - $76800 = $179,200

The rate of interest applied = r = 7.5%

The time period of finance = t = 20 years

Let The Amount after 20 years of finance = $A

Let The total amount to be paid for new home = $B

Now, From Compound Interest

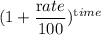

Amount = Principal ×

Or, A = p ×

Or, A = $179,200 ×

Or, A = $179,200 ×

Or, A = $179,200 × 4.24785

∴ A = $761,214.72

So,The Amount after 20 years of finance = A = $761,214.72

Now, Again

The total amount to be paid for new home = Down payment amount + The Amount after 20 years of finance

Or, B = $76,800 + A

Or, B = $76,800 + $761,214.72

Or, B = $838,014.72

So, The total amount to be paid for new home = B = $838,014.72

Hence, The total amount to be paid for new home is $838,014.72 Answer