Answer:

-$300 million

Step-by-step explanation:

Change in net working capital (CNWC) = $100 million

Capital Expenditures (CE) = $200 million

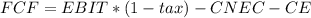

Assuming no depreciation expenses, the free cash flow (FCF) is given by:

Since no revenues are expected until the next year, EBIT = 0.

The project's free cash flow today is -$300 million.