Answer:

correct option is a) 24.87; 24.87

Step-by-step explanation:

given data

spent = $15000

current earnings = $2.80 per share

stock currently sells = $75 per share

shares outstanding = 2,800

top find out

PE ratio

solution

first we get here dividend per share that is express as

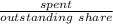

dividend per share =

................1

................1

dividend per share =

dividend per share = $5.3571

and price after dividend will be here as

price after dividend = stock currently sells - dividend per share ............2

price after dividend = $75 - $5.3571

price after dividend = $69.6429

so PE ratio will be

PE ratio is =

PE ratio is = 24.87

and

now we get share repurchased that is

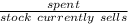

shares repurchased =

.......3

.......3

shares repurchased =

shares repurchased = 200

so EPS will be as

EPS is = 2.80 ×

EPS = 3.015

so PE ratio will be as

PE ratio is =

PE ratio is = 24.87

correct option is a) 24.87; 24.87