Answer:

Marko willing to pay today $23246.51

Step-by-step explanation:

given data

cash flows year 1 F1 = $4,700

cash flows year 2 F2 = $9,700

cash flows year 3 F3 = $15,900

rate of return r = 12 percent = 0.12

solution

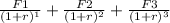

we get here present value that is express as

present value =

..........................1

..........................1

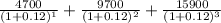

put here value we will get

present value =

present value = $23246.51

so Marko willing to pay today $23246.51