Answer:

correct option is B. -$4.02

Step-by-step explanation:

given data

delivery price = $40

current stock price = $35

fixed dividend yield = 8% = 0.08

risk free rate = 12% = 0.12

solution

as we know that forward contract is a agreement that is made between 2 parties ( seller or buyer ) asset in future at today fix price in specified time,

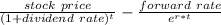

we get here long forward contract value that is express as

long forward contract =

...................1

...................1

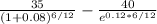

put here value we get

long forward contract =

solve it we get

long forward contract = -$4.02

so correct option is B. -$4.02