Answer:

Hence the net cost to the company is 68,160.

NPV to buy a new truck instead of repairing

NPV = -65390

Step-by-step explanation:

Step 1:-

P.V. of Old Truck Repaired

Given

Discount rate = 6%

New engine = 35000

Life = 5 years

Annual operating expenses = 8500

Salvage (after 5 years)= 3500

Step 2:-

Repair

Net Cost to company = Cost + Annual operating expenses x P.V. Annuity

Factor (6%, 5) - Salvage value x P.V. Intrinsic

Factor (6%, 5)

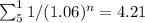

P.V.A.F. (6%, 5)=

n = 4.21

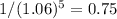

P.V.I.F. (6%, 5) =

Net Cost to company: = 35000 + 8500 x 4.21 - 3500 x 0.75

= 35000 + 35785 - 2625

= 68,160

P.V. of New truck purchased

New Truck

Cost = 120000

Discount rate = 6%

Life = 5 years

Annual operating expenses = 5000

Salvage (after 5 years)= 10000

Net Cost to company: = Cost + Annual operating expenses x P.V. Annuity

Factor (6%, 5) - Salvage value x P.V. Intrinsic

Factor (6%, 5)

= 120000 + 5000 x 4.21 - 10000 x 0.75

= 120000 + 21050 - 7500

= 133550

NPV to buy a new truck instead of repairing

NPV = Net cost of repairing - Net cost of new truck

= 68160 - 133550

= -65390