The question is incomplete. The complete question is :

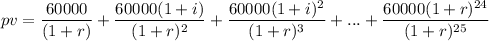

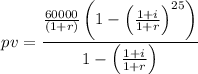

You would like to have enough money saved to receive a growing annuity for 25 years, growing at a rate of 4 percent per year, with the first payment of $60,000 occurring exactly one year after retirement. How much would you need to save in your retirement fund to achieve this goal? (The interest rate is 12%.)

Solution :

Given data :

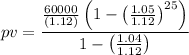

pv of growing annuity, i = 0.04

Rate of interest, r = 0.12

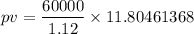

Therefore,

pv = $ 632390.02 (rounding off)