Answer:

a) payment: $1082.84

b) interest: $194,822.40

Explanation:

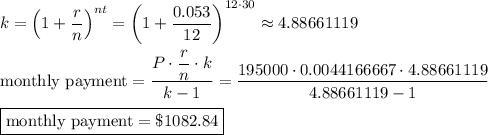

The monthly payment on the mortgage can be found using the given formula with the given values of principal (P=195000), interest rate (r=0.053), and time period (t=30). The value of n is 12, corresponding to the number of months in a year.

a)

The monthly payment is ...

__

b)

The interest owed is the difference between the total of monthly payments and the principal of the loan:

interest owed = (360)(1082.84) -195000 = 194,822.40

The interest owed over 30 years is $194,822.40.