Answer:

a) 0.513 = 51.3% probability that a randomly selected voter in the town supports the tax increase.

b) 0.487 = 48.7% probability that a randomly selected voter does not support the tax increase.

c) 0.1777 = 17.77% probability he or she is a registered Independent.

Explanation:

Conditional Probability

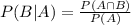

We use the conditional probability formula to solve this question. It is

In which

P(B|A) is the probability of event B happening, given that A happened.

is the probability of both A and B happening.

is the probability of both A and B happening.

P(A) is the probability of A happening.

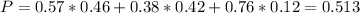

Question a:

57% of 46%(democrats)

38% of 42%(republicans)

76% of 12%(independents)

So

0.513 = 51.3% probability that a randomly selected voter in the town supports the tax increase.

Question b:

1 - 0.513 = 0.487

0.487 = 48.7% probability that a randomly selected voter does not support the tax increase.

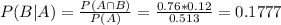

c. Suppose you find a voter at random who supports the tax increase. What is the probability he or she is a registered Independent?

Event A: Supports the tax increase.

Event B: Is a independent.

0.513 = 51.3% probability that a randomly selected voter in the town supports the tax increase.

This means that

Probability it supports a tax increase and is a independent:

76% of 12%, so:

Thus

0.1777 = 17.77% probability he or she is a registered Independent.