Answer:

It will take approximately 25 months

Explanation:

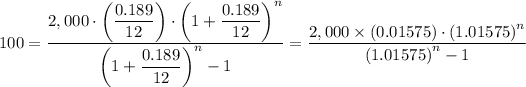

The amount owed on the credit card statement, P = $2,000

The interest rate of the credit on the credit card, r = 18.9%

The minimum monthly payment made, M = $100

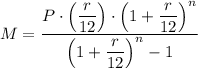

The equal monthly installment formula is given as follows;

Therefore, we get;

100×1.01575ⁿ - 100 = 31.50×1.01575ⁿ

100×1.01575ⁿ - 31.50×1.01575ⁿ = 100

68.5×1.01575ⁿ = 100

1.01575ⁿ = 100/68.5

n = ln(100/68.5)/ln(1.01575) ≈ 24.21 (which is approximately 25 months, by rounding up to the nearest whole number)

Therefore, it will take approximately 25 months to pay off the credit card debt