Solution :

with the same exercise price.

with the same exercise price.

X = exercise price = 50

1). Position to be taken :

-- buy 10 numbers of Put options with strike price of $ 50 per unit.

--- short (sell) 10 numbers of Call option with strike price of $ 50 per unit.

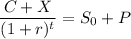

2). Cost of synthetic short position =

,

,

where, P = price of 1 put ption

C = price of 1 call option

The Call - Put parity equation :

Here, C = Call premium

X = strike price of call and Put

r = annual rate of interest

t = time in years

= initial price of underlying

= initial price of underlying

P = Put premium

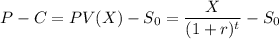

Therefore,

Here, t = 1,

= 48, X = 50

= 48, X = 50

So the cost of the position is given as :