Answer:

Option E (143) is the appropriate solution.

Step-by-step explanation:

According to the question,

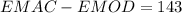

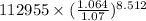

The modified duration will be:

=

=

=

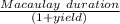

The percentage change in price will be:

=

=

(%)

(%)

Now,

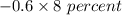

The EMOD will be:

=

=

($)

($)

Or,

The EMAC will be:

=

=

($)

($)

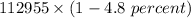

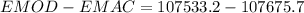

Hence,

⇒

⇒