Answer:

a. Simple interest, S.I = $2,625

b. Total amount = $12,625

Explanation:

Given the following data;

Principal = $10,000

Interest rate = 10.5%

Time = 30 months to years = 2.5 years

a. To find the simple interest;

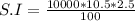

Mathematically, simple interest is calculated using this formula;

Where;

- S.I is simple interest.

- P is the principal.

- R is the interest rate.

- T is the time.

Substituting into the formula, we have;

Simple interest, S.I = $2,625

b. To calculate the total amount Sonia would have to repay the bank;

Total amount = simple interest + principal

Total amount = 2625 + 10000

Total amount = $12,625