Solution :

Calculation of income from operations

Sales Region A Region B

Cost of goods sold 643,500 786,500

Selling expenses 244,500 298,900

Service department expenses 154,400 188,800

Purchasing (working note - 1) 108,090 132,110

Payroll accounting (working note - 2) 72,090 88,110

Income from expenses $ 64,420 $ 78,580

Working note 1

Allocation of purchasing expenses:

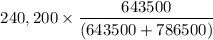

A region =

= $ 108,090

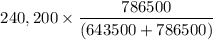

B region =

= $ 132,110

Working note 2

Allocation of payroll accounting expenses.

A region = 160200 x 0.45 (sales ratio)

= $ 72,090

B region = 160,200 x 0.55 (sales ratio)

= $ 88,110