Solution :

Given :

James needs $ 1,000,000 after 15 years.

His IRA deposit is $ 200,000 and is earning at the rate of 8% per annum.

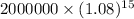

Maturity value of $200,000 after 15 years =

= $ 634,434.

Balance fund needed after 15 years = 1,000,000 - 634,434

= $ 365,566

Therefore, the future value of the annuity is :

![FV=A[((1+k)^n-1)/(k)]](https://img.qammunity.org/2022/formulas/business/college/2fl758pqtkow8i930kqom94bm243mbk1k9.png)

Here, FV = future annuity value = 365,566

A = periodical investment

k = interest rate = 8%

n = period = 15 years

∴

![365566 = A([(1.08)^(15)-1])/(0.08)](https://img.qammunity.org/2022/formulas/business/college/upzjq0i5zn9x4bypkbicahhbp6818tn6dk.png)

A = 13,464

Thus, James needs to save $ 13,464 each year end to reach his target.