Answer:

The correct solution is "28483".

Step-by-step explanation:

According to the question,

Given:

Sales price,

= 32500

MARCS rates,

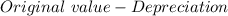

=

=

Or,

=

=

Now,

The total depreciation will be:

=

=

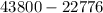

The company's book value will be:

=

=

=

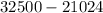

Gain will be:

=

=

Tax,

=

=

hence,

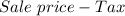

The net cashflows will be:

=

=

=