Answer:

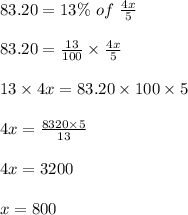

Marked price = Rs 800

Explanation:

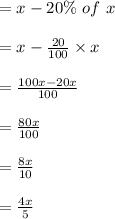

Let the marked price of the cap be Rs.“x”.

Discount = 20%

VAT = 13%

VAT amount = Rs. 83.20

We know,

Discount = Marked price – Selling Price

⇒ Selling price = Marked price – discount

The price after giving a discount or Selling price:

VAT amount = VAT% of Selling Price

Thus, the marked price of the cap is Rs. 800.