Answer:

Step-by-step explanation:

The cost index can be calculated as follows:

In 2019:

= 260400/248000

= 1.05

In 2020:

= 347300/302000

= 1.15

In 2021:

= 350400/292000

= 1.2

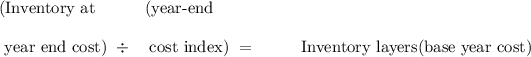

Inventory Layers converted to the base cost

Date

12/31/20 201000 ÷ 1 = 201000

12/31/20 260400 ÷ 1.05 = 248000

12/31/20 347300 ÷ 1.15 = 302000

12/31/20 350400 ÷ 1.2 = 292000

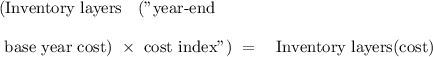

Inventory Layers converted to cost Ending Inventory DVL cost

Base

201000 × 1 = 201000

201000 × 1 = 201000

Dec 31, 2019

47000 × 1.05 = 49350

ADD 250350

Base

201000 × 1 = 201000

Dec 31, 2019

47000 × 1.05 = 49350

Dec 31, 2020

(302000 - 248000)

= 54000 × 1.15 = 62100

ADD 312450

Base

201000 × 1 = 201000

Dec 31, 2019

47000 × 1.05 = 49350

Dec 31, 2021

(292000 - 248000)

= 44000 × 1.15 = 50600

ADD 300950