Answer:

"$9,410,000" is the appropriate answer.

Step-by-step explanation:

Given that,

Fair value,

= $12600000

Cash difference,

= $1070000

Books value before transaction,

= $8340000

Now,

The deferred gain will be:

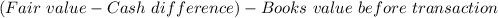

=

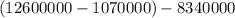

=

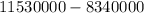

=

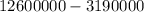

=

($)

($)

hence,

The Kurtz contact value will be:

= Fair value - Deferred gain

=

=

($)

($)