Answer:

The solution according to the given query is summarized in the explanation segment below.

Step-by-step explanation:

Given:

Face value,

= $508,500

Coupon rate,

= 6%

Bonds mature in years,

= 7

Now,

(a)

Issue price will be:

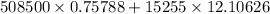

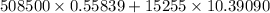

=

=

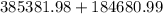

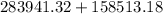

=

($)

($)

(b)

Issue price will be:

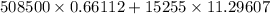

=

=

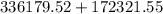

=

($)

($)

(c)

Issue price will be:

=

=

=

($)

($)