Answer:

Machine K

Step-by-step explanation:

The values can be better computed as:

Year 0 1 2 3

J 11000 1200 1`300

K 13000 1200 1300 1400

Using the PV Calculator

The Present Value (PV) for each year in Machine J is as follows:

Cashflow Year Present Value

11000 0 11000

1200 1 1085.97

1300 2 1064.68

Total 13,150.65

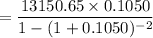

The effective annual cost =

= $7628.16

Using the PV Calculator

The Present Value (PV) for each year in Machine K is as follows:

Cashflow Year Present Value

13000 0 13000

1200 1 1085.97

1300 2 1064.68

1400 3 1037.63

Total 16,188.28

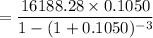

The effective annual cost =

= $6566.92

Therefore, machine K is better to buy than machine J.