Answer:

$ 1.44

Step-by-step explanation:

Given :

The stock price of 1 share = $ 38

The cost of equity capital, r = 15.2%

The capital gains rate for the next year, g = $ 11.4

Therefore, as per the dividend discount model,

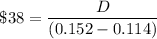

The price per share =

D = 38 x 0.038

= 1.44

Therefore, the dividend = $ 1.44