Answer:

Step-by-step explanation:

Let's first determine the free cash flow of the firm

Particulars Years

1 2 3

EBIT 540 680 750

Tax at 36% (0.36*540) (0.36*680) (0.36*750)

Less: 345.6 435.2 480

Net Capital -

Spending 150 170 190

Change in NWC 70 75 80

Less: 125.6 190.2 210

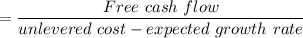

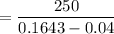

The terminal value at the end of T =(3 years) is:

= 2011.26

Finally, the value of the firm can be computed as follows:

Years Free Cash Flow PVIF PV

1 125.6 0.6589 107.88

2 190.2 0.7377 140.31

3 210 0.6336 133.06

Terminal Value 2011.26 0.6336 1294.33

Value of the firm ⇒ $1655.58