Answer:

Following are the response to the given question:

Step-by-step explanation:

Revenue = $2,600.

Reduced price Term is 1/10, net 30 that is 1% reduction upon on accounts receivable who will pay in 10 days of sales is authorized. Its reduction is recorded in the general ledger and the cash received was entered in accounts receivable upon on date of collection.

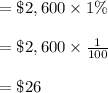

Allowed discount:

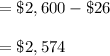

Collection Cash:

Its $2,574 money collecting is documented by Debiting Cash and Crediting Account Receivables throughout the Cash Reception Gourmet at $2,574. The price of the goods sold doesn't always relate to income.