Answer:

Following are the solution to the given question:

Step-by-step explanation:

For point a:

Calculating the Real rate of interest:

For point b:

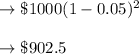

Calculating the Real value of loan repayment:

For point C:

In this question, the creditor receives less than what he granted he losses that's why the creditor is the correct answer.