Answer:

With this policy throughout the long run, the insurance company will make money. A further explanation is provided below.

Step-by-step explanation:

According to the given values in the question,

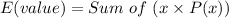

The expected value will be:

⇒

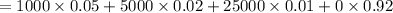

By putting all the given values, we get

⇒

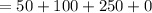

⇒

⇒

($)

($)

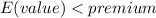

As we can see that,

Thus the above is the correct answer.