Answer:

Following are the solution to the given points:

Step-by-step explanation:

Any agent has a $100 deposit to an institution of assets X to make a demand deposit of $100.

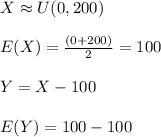

For point a:

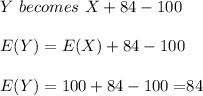

assume Y is the Loss of depositor

The expected loss of depositors

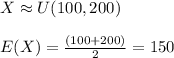

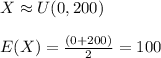

For point b:

The expected loss of depositors

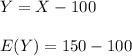

For point C:

The expected loss of depositors

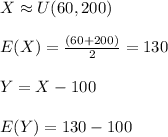

For point D:

Here the government introduce deposits insurance, deposit insurance amount (I) is 84