Answer:

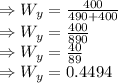

Hence, the expected rate of return after 1 year for Mary's portfolio is

Explanation:

We have,

Purchase 7 shares of stock A for $70 per share and 4 shares of stock B for $100 per share then The expected rate of return after 1 year for Mary's portfolio.

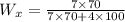

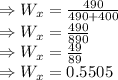

Weight invested in stock A is

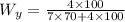

Weight invested in stock B is

The expected value of the rate of return