Answer:

The answer is "Option D".

Step-by-step explanation:

The amount accrued in the pension system until now

Danger or security account proportion

The percentage of the amount kept in a safe account

Number of investment years owned by

Risk-free return rate

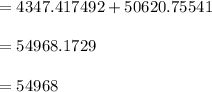

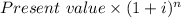

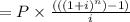

Combined total amount up to age 63 (formula for the current value) =

The contribution is

a year and the employer corresponds with the same amount for the pension plan.

a year and the employer corresponds with the same amount for the pension plan.

Total annual contribution

Risk-free or healthy account proportion

Amount invested annually

Annual deposit amount (n) for years

Returns free of risk

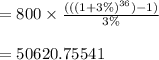

An cumulative sum due to an annuity

Total amount accumulated in safe account

of annuity

of annuity