Answer:

$ 40

Step-by-step explanation:

Given :

Bid price = $ 50

Ask price = $ 50.2

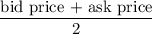

Ideal price =

= $ 50.1

This is the ideal price of the stock that is based on the mid point price.

The transactional cost for the buy is = Ask price - ideal price

= 50.2 - 50.1

= $ 0.1

Thus we have to give $ 0.1 as the transactional cost if we want tot buy the stock immediately, so that we buy it more than the ideal price.

Therefore, the transactional cost for the sales is = ideal cost - bid cost

= $ 50.1 - $ 50

= $ 0.1

Thus we have to pay $ 0.1 as the transactional cost if we want to sell the stock now, so as to sell it cheaper than the ideal price.

We known the quantity = 200

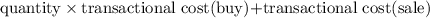

So the round up transactional cost =

= 200 x (0.1 +0.1)

= $ 40