Answer:

your tax deduction for the first 2 months is $1,199.40

Step-by-step explanation:

given data

loan PV = $500,000

interest rate r = 6% = 6% / 12 = 0.5%

time period t = 30 year = 360 months

total transaction cost = $3,000

marginal income tax rate = 24%

to find out

What is your tax deduction for the first 2 months

solution

first we get here monthly payment that is

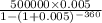

monthly payment =

...............1

...............1

monthly payment =

monthly payment = $2997.75

So

for 1st month interest is = $500000 × 0.005

1st month interest = $2500

and

for 2nd month interest

interest = [ $500000 - ( $2997.75 - $2500 ) ] × 0.005

2nd month interest interest = $2497.51

so

total interest paid in 2 month is = $2500 + $2497.51

total interest paid in 2 month = $4997.51

and

tax deduction is = $4997.51 × 0.24

tax deduction is = $1199.40