Answer:

The expected spot rate of the Australian dollar in one year = 1.28 AUD per USD

Step-by-step explanation:

The Current spot rate of Australian dollar against US Dollar

=

AUD /USD

AUD /USD

AUD per USD.

AUD per USD.

Inflation rate in Australia

%

%

Inflation in the US

%

%

Percentage change in Australian currency

%

%

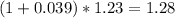

Thus, the spot exchange rate of AUD 1 year from now will be

AUD per USD.

AUD per USD.