Answer:

Following are the responses to the given question:

Step-by-step explanation:

For point a:

patent cost

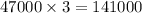

Start dividing by the useful life =8

Amortization per year

Amortization for 3 years=

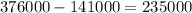

3 Year end-of-year book value=

The cost of a lawsuit has been added

Year 4's book value

Multiply by the useful life

Year 4 patent amortization cost

For point b:

Amortization expense 50800

Patent 50800