Answer:

The firm's WACC will be "8.04%".

Step-by-step explanation:

The given values are:

Yield of maturity,

= 7.75%

Rate of tax,

= 40%

Next year's dividend,

= $o.65

Growth,

= 6%

Share price,

= $15

Flotation cost,

= 10%

Now,

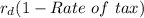

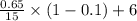

=

On substituting the values, we get

=

=

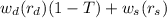

The

will be:

will be:

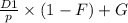

=

=

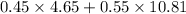

=

=

hence,

The firm's WACC will be:

=

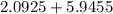

=

=

=

%

%