Answer:

The net swap payment made is $49.

Step-by-step explanation:

In order to find the solution the values are used which are as follows:

The Value of interest in each year is calcuated as follows

The values of interest rate and amount for 3 years are as follows:

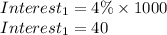

- Interest rate for year 1 is 4% for an amount of 1000

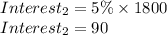

- Interest rate for year 2 is 5% for the amount of 1800

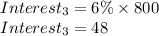

- Interest rate for the year 3 is 6% for the amount of 800.

These values are calculated as follows:

Similarly

Also

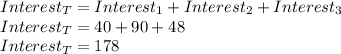

So the total interest is

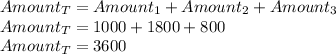

The total amount is given as

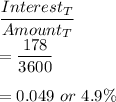

Fixed rate is given as

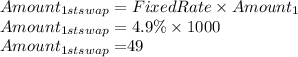

Now for the swap payment made at the end of first year is