Answer:

The total cost of establishing the portfolio is $2054.95.

Step-by-step explanation:

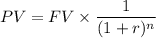

The present value of a bond is given as

For 1 year zero-coupon bond is

- FV is 500

- r is 7% or 0.07

- n is 1

So the value is

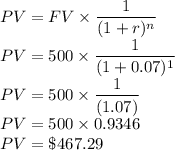

Similarly, for 3 years zero-coupon bond is

- FV is 2000

- r is 8% or 0.07

- n is 3

So the value is

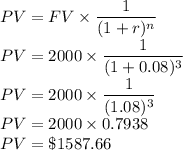

So the total cost is

Total Cost=Cost of 1-year zero-coupon bond+Cost of 3-years zero-coupon bond

Total Cost=$ 467.29+$ 1587.66

Total Cost= $ 2054.95

So the total cost of establishing the portfolio is $2054.95.