Solution :

Calculation of the

for both

for both

and

and

where EBIT is 2.6 million.

where EBIT is 2.6 million.

EBIT $ 2.6 million $ 2.6 million

Less : Interest $ 1.1 million

Less

PAT $ 2.6 million $ 1.5 million

Earnings available $ 2.6 million $ 1.5 million

for share holder

No. of shares 765,000 515,00

= earnings available $ 3.40 $ 2.9

= earnings available $ 3.40 $ 2.9

for share holder/no. of

shares

Hence

under the

under the

is $ 3.40 and

is $ 3.40 and

is $ 2.91

is $ 2.91

Calculating the

for both plan I and

for both plan I and

where EBIT is $ 3.1 million

where EBIT is $ 3.1 million

EBIT $ 3.1 million $ 3.1 million

Less : Interest $ 1.1 million

Less

PAT $ 3.1 million $ 2.0 million

Earnings available $3.1 million $ 2.0 million

for share holder

No. of shares 765,000 515,00

= earnings available $ 4.05 $ 3.88

= earnings available $ 4.05 $ 3.88

for share holder/no. of

shares

Hence,

under the

under the

is

is

and

and

is

is

Calculating the breakeven EBIT

When

the relative effectiveness leverage versus equity financing companies look for the level of the EBIT where

the relative effectiveness leverage versus equity financing companies look for the level of the EBIT where

remains unaffected, called the EBIT-EPS breakeven point .

remains unaffected, called the EBIT-EPS breakeven point .

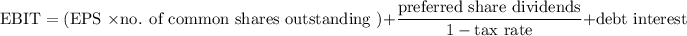

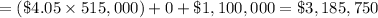

To calculate the EBIT-EPS breakeven point, rearranging the

formula:

formula:

Therefore, the break even EBIT is $ 3,185,750