Answer:

7.95%

Step-by-step explanation:

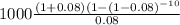

the first step is to determine the present value of the 10 year annuity

= 7246.89

= 7246.89

remaining balance of the 10,000 is invested in a 10-year certificates of deposit = 10,000 - 7246.89 = $2753.11

We would calculate the future value of this amount

The formula for calculating future value:

FV = P (1 + r/m)^mn

FV = Future value

P = Present value

R = interest rate

N = number of years

m = number of compounding

$2753.11 x ( 1 + 0.09/4)^(4 x 10) = 6704.34

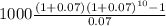

calculate the value of reinvestments

= 14783.60

= 14783.60

14783.60 + 6704.34 = 10,000 ( 1 + er)^10

er = 0.0795 = 7.95%