Answer:

$400,152

Step-by-step explanation:

Given :

Amounts payable = 200,000 pounds

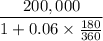

Fuds required =

= 194,174.76 pounds

Cost of dollars = 194,174.76 x 2.02

= $ 392,233

Therefore, the amount borrowed today in dollars = $ 392,233

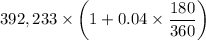

The payment of loan after the 180 days =

= $ 400,077.67

= $ 400,152 (rounding off)

The number of days taken in a year = 360