Answer:

"$ 15,000" is the correct solution.

Step-by-step explanation:

The given values are:

Agreed fixed rate,

= 0.04

LIBOR rate,

= 0.01

No. of borrowing months,

= 6

National amount,

= 1000000

Now,

The net payment will be:

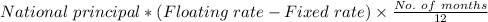

=

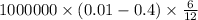

On substituting the above values, we get

=

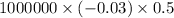

=

=

($)

($)