Answer:

a-The Linear Model is as follows:

b-The values are

X=$33,333.33

Y=$16,666.67

Z=$50,000.00

Leading to a total expected return of $4333.33.

c-The values of constraints are as follows

X+Y+Z=33333.33+16666.67+50000=100,000

X=33%, Y is 16.67% and Z is 50%

Risk component of X is 0.33

Risk component of Y is 0.66

Risk component of Z is 4.00

Explanation:

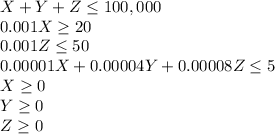

a

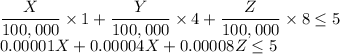

From the conditions, the first special constraint is the total amount which is that the sum of investments must not be more than the total available amount of $100,000 so

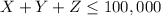

The second special constraint is that the percentage of X must be at least 20% So

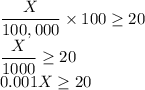

The third special constraint is that the fraction of total investment of Z must not exceed 50% So

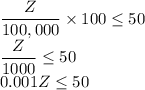

The fourth special constraint is that the combined portfolio risk index must not exceed 5 so

As the investments cannot be negative so three basic constraints are

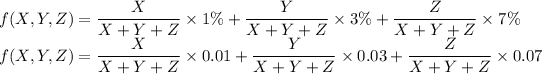

The maximization function is given as

b

By using an LP solver with BigM method the solution is as follows:

X=$33,333.33

Y=$16,666.67

Z=$50,000.00

Leading to a total expected return of $4333.33.

c

The values of constraints are as follows

X+Y+Z=33333.33+16666.67+50000=100,000

X=33%, Y is 16.67% and Z is 50%

Risk component of X is 0.33

Risk component of Y is 0.66

Risk component of Z is 4.00