Solution :

Method I : SL method

Cost of equipment = $ 500,000

Salvage value = $ 50,000

Expected life = 5 years

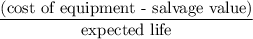

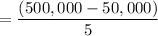

Depreciation =

= 90,000

Therefore, the

is $ 90,000 using the SL method.

is $ 90,000 using the SL method.

Method II : DDB method

Cost of equipment = $ 500,000

Expected life = 5 years

So, calculating the

at the end of the year 1 is :

at the end of the year 1 is :

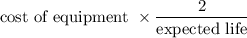

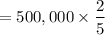

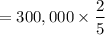

Depreciation =

= $ 200,000

So the book value at the end of the year 1 = $ 500,000 - $ 200,000

= $ 300,000

Now calculating the

at the end of the year 2 is :

at the end of the year 2 is :

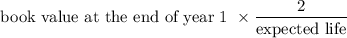

Depreciation =

= $ 120,000

Therefore, the

value is $ 120,000 using the DDB method.

value is $ 120,000 using the DDB method.

Method III : 150% DB method

Cost of equipment = $ 500,000

Expected life = 5 years

So, calculating the depreciation in year 1 is :

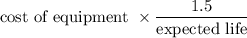

Depreciation =

= $ 150,000

So the book value at the end of the year 1 = $ 500,000 - $ 150,000

= $ 350,000

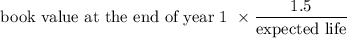

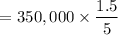

Now calculating the depreciation in year 2 is :

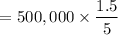

Depreciation =

= $ 105,000

Therefore, the

value is $ 105,000 using the 150% DB method.

value is $ 105,000 using the 150% DB method.