Answer:

Equipment 2,251,669.78 DEBIT

Cash 470,000.00 CREDIT

Lease Liability 1,781,669.78 CREDIT

--to record the beginning of the lease--

Lease liability 291,833.02 debit

interest expense 178,166.98 debit

loss on monetary position 23,500 debit

Cash 493,500 credit

Step-by-step explanation:

We solve for the present value of the six payment of 470,000 to know the lease liability

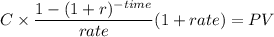

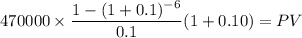

Present Value of Annuity

C 470,000

time 6

rate 0.1

PV $2,251,669.7816

We subtract the first payment of 470,000

Lease liability account: 1,781,669.78

Second payment journal entry:

interest calculations:

1,781,669.78 x 0.1 = 178,166.98

principal payment:

470,000 - 178,166.98 = 291,833.02

inflation' adjustment:

470,000 x 126/120 = 493,500

The difference will be a loss on monetary position by the difference:

493,500 - 470,000 = 23,500